Scammers are a huge headache. You’re just minding your day, enjoying the weekend. Suddenly, you’ll receive an email saying that your account has been locked. You remember clicking a link from a social media giveaway. Now, you’re panicking, and your weekend is ruined.

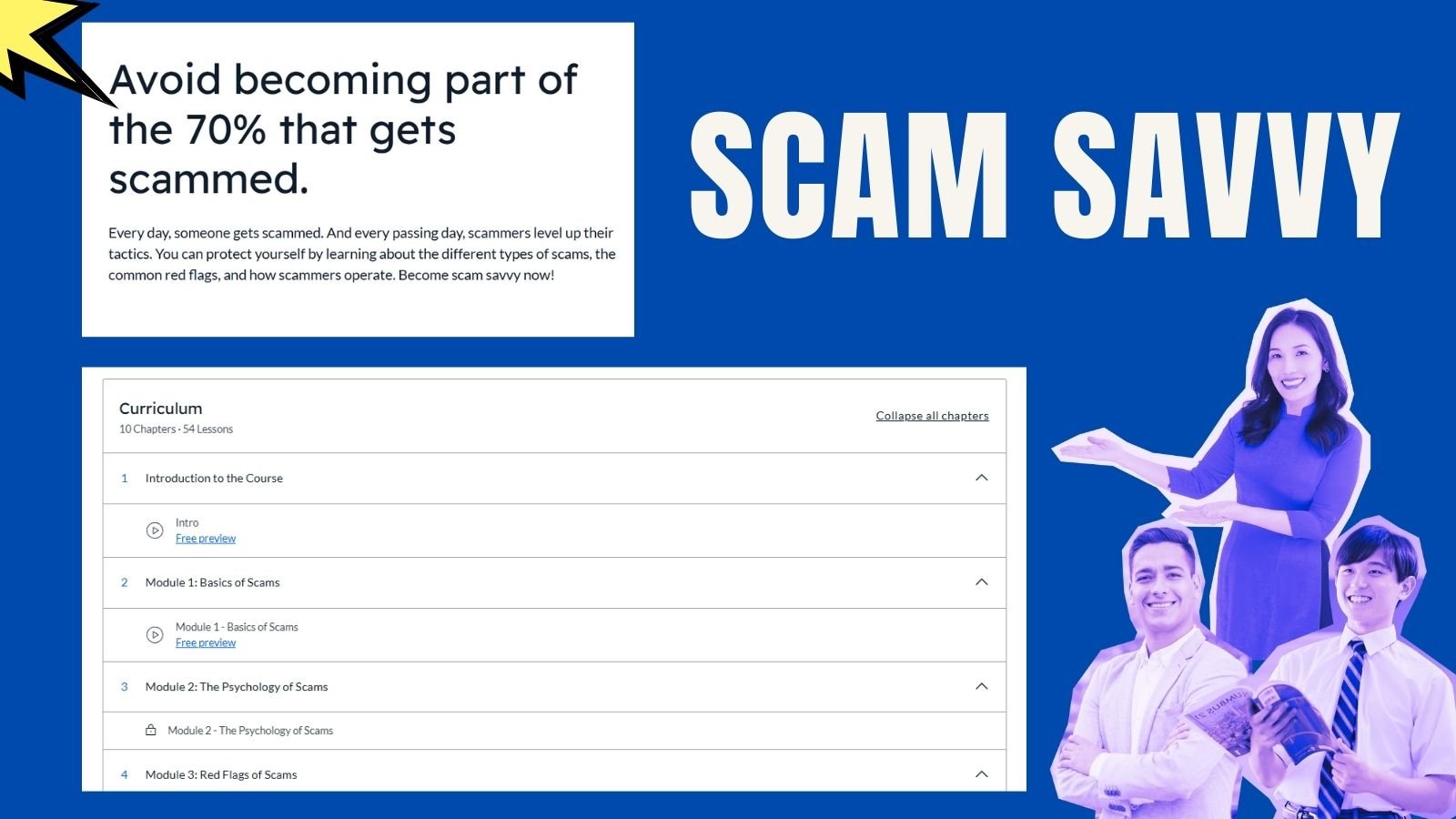

Scam Savvy is an online course designed to help people learn about scams to reduce scam victimization rates. The course covers 90 scams, the basics of scams, the psychology behind them, prevention tips, real-life scam cases, and more.

One way you can avoid becoming a scam victim is by learning. As the adage goes, “knowledge is power.” The more you know, the better you can protect yourself. Think about it, when you know how magicians work, you won’t be tricked easily, no matter how convincing their act is.

The Problem: Scams

Before we discuss the solution, let's address the problem. How much of a problem are scams?

Scams cause huge financial losses. In fact, according to the FTC, victims reported losing over $12 billion to scams in 2024. According to the Global Anti-Scam Alliance, the average loss per victim in the US is approximately $3,000.

Aside from the financial loss, scams cause other lasting impacts, such as:

- Reputational Damage: If scammers used your identity or business to scam others, it will cause long-lasting harm to your reputation. Customers may no longer trust your business.

- Sudden Change in Financial Habits: After being victimized, you may become more risk-averse. This means you could become more hesitant to invest or distrust online banking services. These can affect your future finances.

- Lifestyle Adjustments: Some scam victims may be so severely affected that they’re forced to make significant life changes, such as relocating for safety. This can drastically change their way of living.

- Mental Health Issues: According to research, being victimized can also lead to long-term mental health issues. This includes extreme stress, anxiety, depression, post-traumatic stress disorder, insomnia, and suicidal thoughts.

Overall, scams are a big problem. So, you need to do something, which brings us to the solution.

The Solution: Scam Savvy

“Scam Savvy: How to Protect Yourself and Spot a Scam” is a course made to help people learn about scams, with the hope of reducing the number of people being victimized.

Here’s what you can get:

- 8 Chapters discussing everything from the basics of scams to what to do if you’re scammed.

- 30 common scams carefully explained.

- A final assessment designed to practice what you’ve learned.

- 60+ more scams.

- Real-life scam cases that will help you understand the impact of scams and prevention tactics.

This course was designed in a way that will help you easily and effectively understand how scammers work, how to prevent being scammed, and what you should do in case you’re scammed.

Each lesson is made to be digestible. So, you don’t have to worry about information overload. Plus, you can take the course at whatever pace you want. There’s no time limit!

You can check our free preview of Introduction to the Course and Module 1 - Basics of Scams now!

Frequently Asked Questions

What are common scam phrases?

Scammers often use phrases that affect our emotions and create urgency, such as: “Act fast,” “Your account is about to be suspended,” “Your relative needs emergency cash,” or “You’ve won an exclusive reward.” Scammers also use phrases to impersonate authorities, such as: “This is the police. You’re under investigation.”

What are the golden rules of protecting yourself against scams?

There are 8 rules to follow for protection against scams: 1) be diligent when engaging with strangers, 2) trust your instincts, 3) avoid clicking links from texts and emails, 4) always verify identities and claims, 5) research companies thoroughly, and 6) be scam smart even at work.

What are the common signs of loan scams?

You’ll know it’s a loan scam through these red flags: 1) unrealistic loan offers, 2) requests for upfront fees, 3) no checks on credit or income, 4) vague loan terms, and 5) early requests for personal and banking information.