Retirement is the time for you to enjoy. It’s about spending time with your grandkids, sipping warm coffee on the porch, or maybe finally taking that trip to the Grand Canyon. It’s about peace. But in the background, there’s a threat that can ruin your retirement in an instant.

Retirees can protect themselves from hacks, scams, and data collection by opting out of data collection, shredding documents, using strong passwords, securing their mail, and freezing their credit.

Did you know that retirees have lost over $3 billion to fraud? That’s according to The National Council on Aging (NCOA). Plus, retirees are often targeted by hackers, scammers, and creepy companies.

Risks That Retirees Face

You can protect yourself by understanding the risks associated with it.

Risk No. 1: Data Collection

Our data is always being collected by car companies, insurers, social media platforms, data brokers, and more.

And it’s so easy. Every time you go online, fill out a form, buy something, sign up for a loyalty card, and even join an online contest, your data is collected.

It’s not just a collection; your data is also being sold. For example, data brokers like Whitepages and PeopleFinders collect your information, and then let others search for your name and phone numbers.

Data brokers like Spokeo, Whitepages, and PeopleFinders gather and sell your info — often without you even realizing it.

This is a problem because it can get out of control. Some companies collect data without clear consent. More often than not, they’ll say “using our service makes you subject to data collection and sharing,” but you won’t know about it because it’s buried in long, complicated terms and conditions.

Also, it can lead to data misuse. The data collected on you is used to create profiles that can either reinforce biases or amplify misinformation.

For example, there have been reports of car companies like Ford and General Motors sharing data with insurance companies. This has led to spikes in insurance premiums. That’s what Kenn Dahl experienced.

What’s worse, companies can get hacked, which is the second risk.

Risk No. 2: Data Breach

Even if you don’t share much of your information online, the companies that have your data (e.g., banks, pharmacies, phone companies, etc.) can be breached, compromising your information.

A recent data breach has exposed over 16 billion login credentials for social media, email, banking, work accounts, and even government websites. This happened because hackers used “infostealers,” malicious software that quietly steals information from your phone or computer.

Your information could be used for extortion or could be sold on the dark web. There, cybercriminals can buy it and then use it for schemes like phishing, identity theft, and account takeovers.

Risk No. 3: Scams

With your information, you’ll be targeted more with different scams.

For example, with your phone number, scammers can call you pretending to be from Medicare. They’ll say that you can get a new card for more benefits.

If your health condition somehow gets leaked, scammers can also use that to make the call more convincing. They’ll mention your health conditions. Since you’re experiencing those, you’ll likely trust them and comply with their requests.

Risk No. 4: Identity Theft

Lastly, scammers can use your information to steal your identity. This means they can open credit cards, reroute your Social Security benefits, or apply for loans in your name.

They’ll receive everything. Meanwhile, you’ll lose money and deal with a lot of stress from damaged credit, identity theft, reclaiming your identity, long-term financial recovery (which can take years), and even legal issues.

Opt Out Guide For Retirees

One way to protect yourself is by opting out. This will help you reduce the amount of data that’s out there. That means fewer chances of being targeted with advertising and scams.

You can do this manually by:

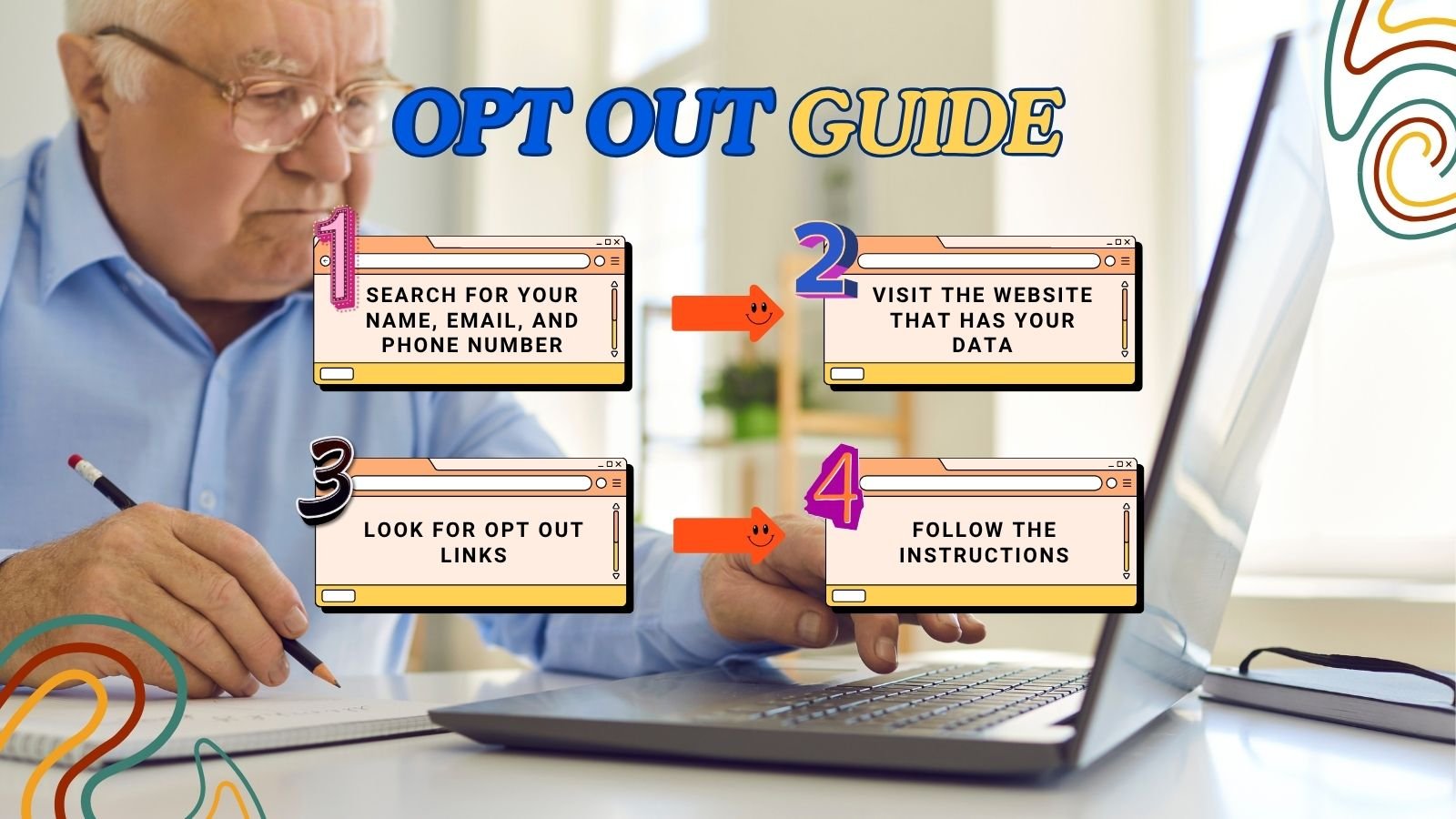

- Opting out of data brokers and people search sites: Search for your name, phone numbers, and email address online to see which sites have your data. Then, visit the websites, look for and follow their opt-out instructions.

- Stopping junk mail: Go to DMAchoice.org, which helps you control what types of mail you receive. It’s quick and free. You can also contact the senders directly and request to be removed from mailing lists.

Keep in mind that while you can opt out of data brokers and people search sites on your own, it can take time. There are thousands of them, and their removal processes take days, weeks, and even a month.

Not to mention, even if you have already opted out, data brokers can recollect your information after some time. So, you have to regularly check, at least every month, and opt out again.

If you don’t have the time to opt out, you can get help from our service. We can opt out on your behalf, and we do it fast. Plus, we offer ongoing monitoring so that your data gets removed right after it reappears.

Additional Tips for Retirees

Now, it’s not only your online data that you have to protect. There are other things in your daily life to protect—from your mail to your credit.

Here are other privacy tips that you should know:

- Shred Sensitive Documents: Our documents can reveal so much information. As a retiree, you probably have documents like pension and retirement account statements, prescriptions, Medicare correspondence, and bank statements. You have to shred unnecessary documents before you dump them, because if not, bad guys can look for your documents in the trash and use your information for identity theft. This is a tactic called dumpster diving.

- Use Strong Passwords + 2FA and Password Manager: Make sure that your accounts are secure by using strong passwords. It should be 16 characters long and a unique mix of letters, numbers, and special characters. Avoid a password like “123456.” To make it more secure, use two-factor authentication, which is like a second lock. That way, in case one key or password gets stolen, bad guys can’t still break in. Lastly, use a password manager (e.g., Bitwarden and LastPass) which can help you avoid using weak passwords and from forgetting your login credentials.

- Secure Your Mail: Remember, bad guys can get information from your documents. That’s why you also have to protect your mailbox. You can use a locking mailbox or a P.O. Box.

- Consider a Credit Freeze: Whenever possible, you can freeze your credit. This will help you stop identity thieves from opening accounts or taking loans in your name. It’s free. You just have to contact credit bureaus to request a credit freeze.

Conclusion

Overall, retirement should be about freedom and peace. You shouldn't have to worry about your information being used to target you.

While this digital and technological world can be overwhelming, there are a few easy, intentional steps you can take to protect yourself.

Start small. You can shred your documents today, then opt out of one site tomorrow.

Frequently Asked Questions

How can you protect your privacy in this age of big data?

You can protect your privacy primarily by doing a regular review of four key data management processes, including 1) data collection, 2) retention, 3) data use, and 4) management of disclosure policies.

What is the importance of protecting your information?

Protecting your data is important because it prevents data misuse, identity theft, scams, and unauthorized access. So, use data security measures like strong passwords and encryption. Also, there should always be informed consent to collect or share your data.